Shadowfall vs Eurofins - the first blog post

Eurofins deep dive pt 6. First a scathing blog post from Shadowfall on July 1 2019.

TL,DR

ShadowFall's concerns about Eurofins stemmed from a combination of potential conflicts of interest with its auditors, questionable audit practices, and a complex and rapidly changing company structure that made it difficult to assess the true financial health of the company. In Pt 7 to come, Shadowfall discloses the full evidence behind its short position.

Introduction

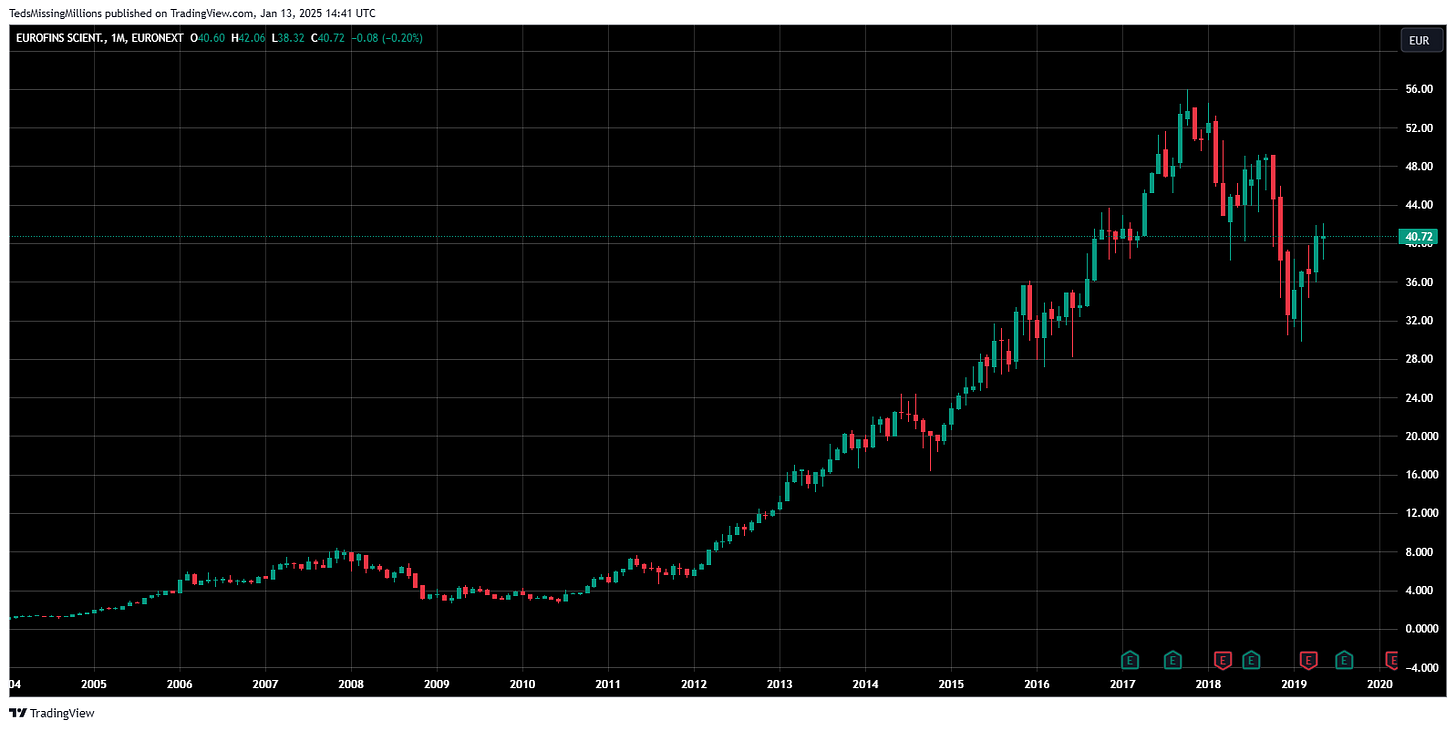

On the 1st July 2019 the chart of Eurofins share prices looked like this:

This was the moment when Shadowfall started talking to the world aboout Eurofins and it started with a blog post.

Matthew Earl: “If we thought UK auditors can on occasion be cosy with their clients, over in France things are (as one might expect) positively romantic.”

Blog 1st July 2019

A foretaste of the more comprehensive document to come, this blog post discussed three main issues, concerns about auditors, governance issues with family members the sheer compexity of the structure and some questionable finance and accounting issues.

ShadowFall's concerns about the auditors of Eurofins, stem from a number of issues, primarily revolving around potential conflicts of interest, lack of independence, and questionable practices. Shadowfall beleived that these concerns were amplified by the company's complex and rapidly changing structure.

Close Relationships and Lack of Independence:

Long Tenure of PwC: ShadowFall notes that PwC had been the auditor for Eurofins for at least 18 years. This long-standing relationship could have led to a "cosy" environment where auditors may have been less likely to challenge the company's practices. Although Eurofins stated they were happy with PwC, they changed auditors due to concerns about the length of the relationship.

Family Ties: Shadowfall believed that the presence of the CEO, his brother, and the CEO's spouse on the Eurofins board created a potential for conflicts of interest and undue influence on the audit process.

Auditing the CEO's Private Companies: ACSe, a small audit firm based in Luxembourg, audited not only Eurofins' subsidiaries but also the private companies of Eurofins' CEO. This dual role may have created further conflicts of interest. These private entities included Analytical Bioventures SCA and International Assets Finance S.à.r.l.

Financial Dependence of ACSe: The audit work performed for Eurofins and its CEO's companies likely represented at least 8% of ACSe's total revenue in 2018. This dependence on Eurofins as a client could compromise ACSe's objectivity and independence.

Questionable Practices:

Temporary Ban on Erik Snauwaert: Erik Snauwaert, the principal signee for the audit reports of Eurofins’ Luxembourg and some Belgian entities, was subject to a temporary ban from signing statutory audit reports for twelve months by the CSSF in March 2017. Despite this, he continued to sign audit reports for Eurofins subsidiaries after the ban was implemented.

Contradictory Statements Regarding Luxembourg Law: Although Mr Snauwaert claimed the ban did not prevent him from undertaking audit work not governed by Luxembourg law, he signed an audit report for Eurofins Forensics Lux Holding that stated the accounts were in accordance with Luxembourg law. This was done after his ban was implemented. ShadowFall wrote to Mr. Snauwaert for clarification, but they had not received a response at the time of publication.

ShadowFall's concerns regarding the structure of Eurofins, primarily revolved around its complexity and rapid changes, which they believed make it difficult to audit and understand the true financial health of the company.

Rapid Expansion and Acquisitions: Eurofins had grown rapidly through acquisitions, purchasing approximately 60 businesses in 2017 and 50 in 2018. This equated to an average rate of one acquisition per week, which ShadowFall described as an impressive figure for any management team. This rapid expansion makes it challenging to audit the company effectively. The company also seemingly gained 10,000 more staff and twice as many laboratories within the space of one year, increasing the complexity of its structure.

Numerous Subsidiaries: The company has a large number of subsidiaries. In 2016, it had around 560 subsidiaries, which increased to over 700 in 2017, and approached 800 by 2018. This large and growing number of subsidiaries makes it difficult for auditors to track the company's financial health.

Intercompany Transactions: There are substantial and increasing intercompany transactions that add another layer of complexity. In 2018, Eurofins Scientific S.E. (the top company) advanced €2,732m to its affiliated undertakings, an increase of €2,207m from the €526m it advanced in 2017. Meanwhile, Eurofins Scientific S.E. owed €1,967m to its undertakings in 2018, an increase of €1,733m from the €234m it owed in 2017. These significant increases in amounts owed by and to subsidiaries adds to the difficulty in auditing the group.

Shifting Cash Balances: Eurofins appears to be holding increasing amounts of its cash at the subsidiary level rather than at the parent company level. In 2017, Eurofins Scientific S.E. held €492m of its total €820m in cash, but by 2018 this had declined to €120m of its total €559m balance. This shift in cash holdings further complicates the financial picture.

Lack of Transparency: ShadowFall states that the company has a "complicated and seemingly ever-changing structure". The various transactions and shifting cash positions make it harder to follow the money.

ShadowFall believed these factors contribute to an environment where it is difficult to have confidence in the financial statements of the company.